When the Federal Reserve raised its key short-term interest rate late last year, the bond market began pricing in higher rates across all maturities. But instead of rising, yields on super-safe Treasuries have been declining.

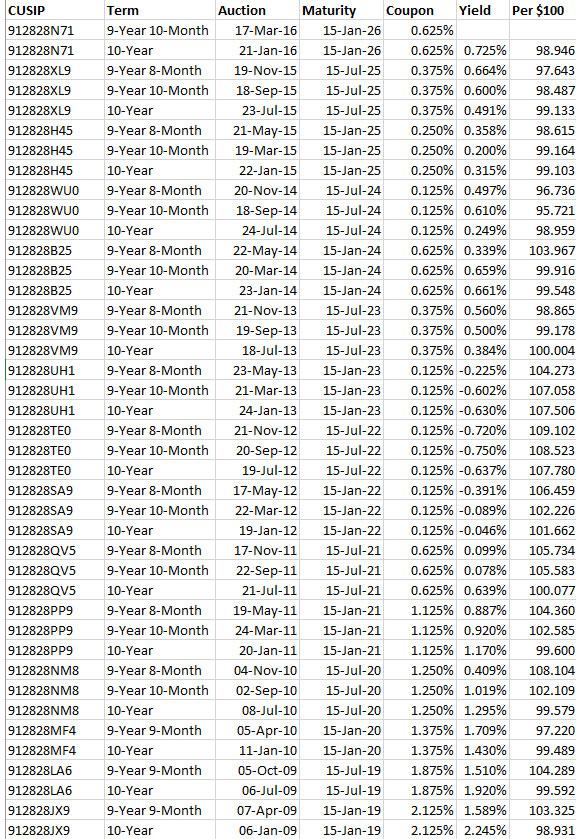

The Treasury will announce later this morning that it will reopen CUSIP 912828N71, a 10-year Treasury Inflation-Protected Security that first auctioned[1] on Jan. 21 with a coupon rate of 0.625% and a real yield (after inflation) to maturity of 0.725%, the highest for any 9- to 10-year TIPS auction since May 2011.

The result of the March 17 auction will be a 9-year, 10-month TIPS with a coupon rate of 0.625%. I was a buyer at the January auction, but a lot has changed in two months.

While this TIPS first auctioned at a discount to par (about $98.95 for $100 of value), it is now trading on the secondary market at a premium to par (about $102.48 for $100 of value.)

Why? Because its yield to maturity - which is determined by the market - has fallen to 0.36%, a rather remarkable drop of about 36 basis points in two months. When the yield falls, the value of the TIPS rises. And that means buyers at next Thursday's auction will have to pay a premium for this reopened TIPS.

If you are interested, here is how to track the likely yield and price at the March 17 auction, which closes at noon for noncompetitive bids.

- Check Bloomberg's Current Yields[2] page. The 10-year TIPS listed there is CUSIP 912828N71, so you can track its real time price. Right now it is trading with a real yield of 0.36% and a price of about $102.48 for $100 of par.

- Check the Wall Street Journal's Closing Prices[3] page. Look for the TIPS maturing 2026 Jan 15 with a coupon rate of 0.625%. It closed yesterday with a yield of 0.37% and a price of about $102.44.

- Check the Treasury's Real Yields Curve[4] page, which shows the Treasury's estimate of yield for a full-term TIPS. Yesterday's estimate was 0.39% for a 10-year TIPS.

One other factor that will affect the price investors pay is the inflation index[5] of this TIPS, which will be set at 0.99702 on the March 31 closing day. That will slightly lower its cost, because a buyer of $10,000 of this TIPS will actually be receiving $9,970.

The auction will come one day after the February inflation report is issued on March 16 at 8:30 a.m. January's report[6] showed a slight uptick in inflation; if that trend continues the TIPS market could see more demand, driving yields lower.

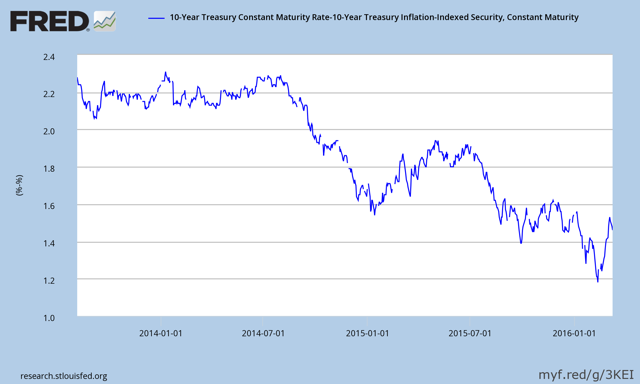

Inflation breakeven rate. Even with the lower yields of 2016, TIPS remain an attractive investment today versus traditional Treasuries. The market is pricing in extremely low inflation, although that number has been climbing.

At yesterday's close, a 10-year nominal Treasury yielded 1.90%, while a 10-year TIPS yielded 0.39%, setting up an inflation breakeven rate of 1.51%. While this is low, it is up from the ultra-low 1.30% of the original auction on Jan. 21. Looking at the longer-term trend, when the 10-year breakeven rate rises above 2.5%, TIPS are getting expensive, when it falls below 2.0%, TIPS are getting cheap. TIPS remain cheap today versus nominal Treasuries.

For a more detailed discussion on breakevens, read Michael Ashton's recent article, TIPS Are Less Cheap - But Still Very Cheap[7]. He makes this point:

.... what this means for the individual investor is that there is no strategic reason to own nominal bonds now. If I own nominal Treasury bonds, I would be moving into TIPS in preference to such a low-coupon, naked-short-inflation-risk position.

If inflation is truly waking up, TIPS are going to be a safe harbor in the storm, especially if purchased and held to maturity. This TIPS - even with its lower yield and higher breakeven rate - could be an attractive investment.

It will reopen again in May and the Treasury will issue a new 10-year TIPS in July.

Here is a chart showing all 9- to 10-year TIPS auctions since January 2009. We've seen some remarkable swings over the last seven years.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

References

- ^ first auctioned (seekingalpha.com)

- ^ Current Yields (www.bloomberg.com)

- ^ Closing Prices (online.wsj.com)

- ^ Real Yields Curve (www.treasury.gov)

- ^ inflation index (eyebonds.info)

- ^ January's report (seekingalpha.com)

- ^ TIPS Are Less Cheap - But Still Very Cheap (mikeashton.wordpress.com)